how much taxes are taken out of paycheck in michigan

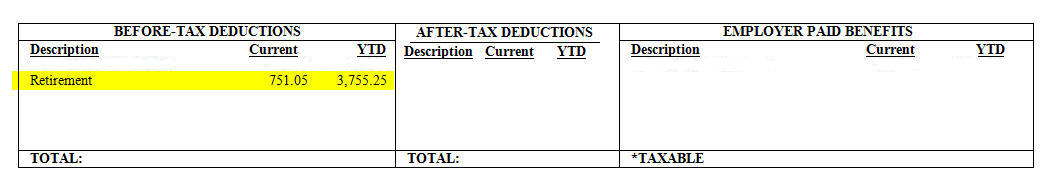

Able to claim exemptions. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Michigan Income Tax Calculator Smartasset

2 Illinois State Income Tax Illinois State Income Tax.

. Amount taken out of an average biweekly paycheck. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. The average amount taken out is 15 or more for deductions including social security.

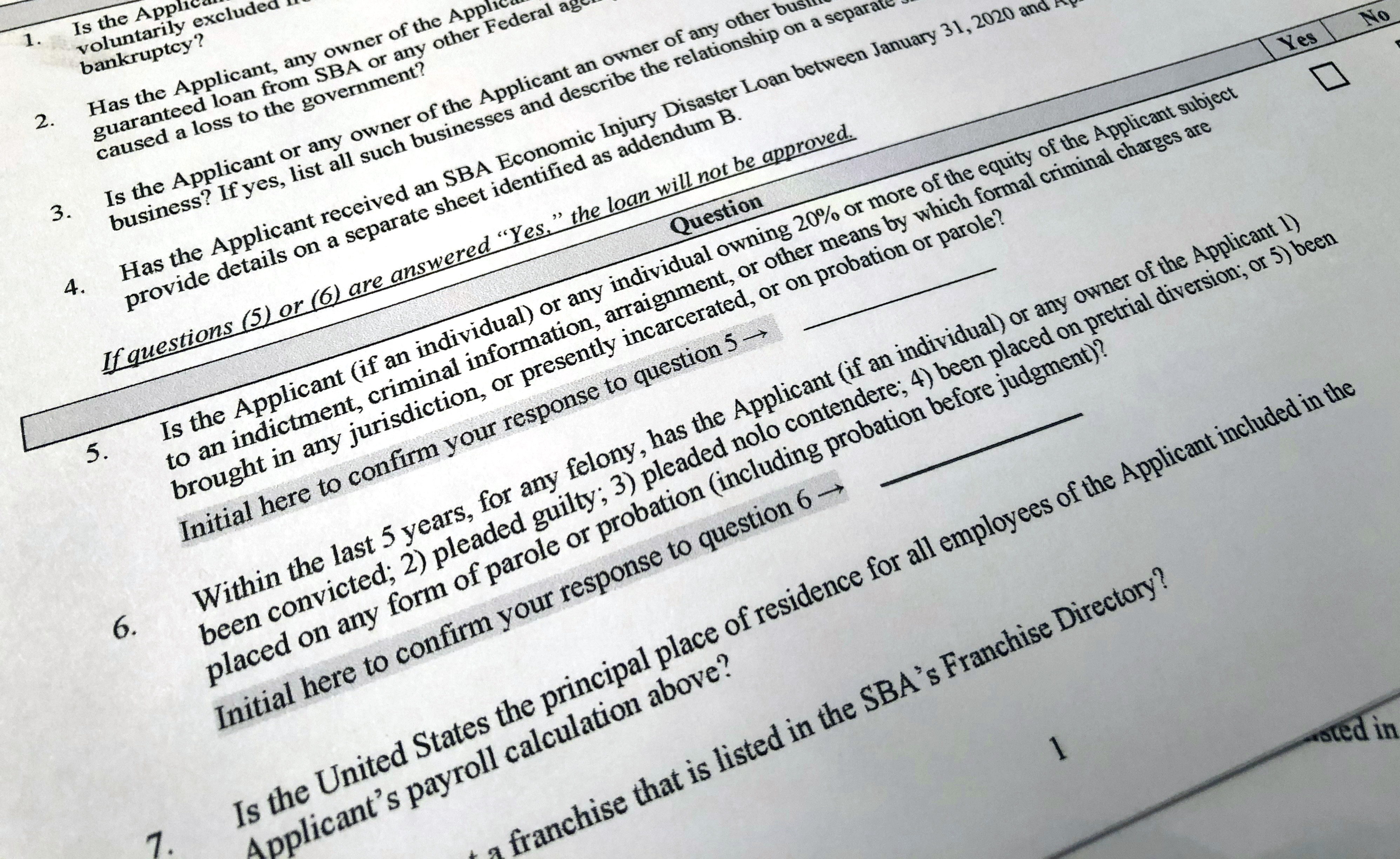

Making the request is a simple matter of filing Form 9465 with the IRS. 1 Federal Income Tax is imposed. In the absence of a Form W-4 claiming exemption the employer is required to deduct federal income tax from the employees wages.

Every Michigan employer who is required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax. FICA taxes consist of Social Security and Medicare taxes. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

The IRS suggests paying what you can and reaching out to take advantage of one of its payment options to deal with the balance. Switch to Michigan hourly calculator. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Michigan Salary Paycheck Calculator. However they dont include all taxes related to payroll. No state-level payroll tax.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Switch to Michigan salary calculator. The calculation is based on the 2022 tax brackets and the new W-4 which in.

So for example if you make 65000 in 2022 your federal tax rate would be 22 plus 597 New York state tax. Where can I get more. Total income taxes paid.

These amounts are paid by both employees and employers. Plan recipients who are tier 2 taxpayers the recipient or his or her spouse born 1946 through 1952 may deduct up to 20000single filer or 40000joint filers. The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim.

This will at least cut the 05. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. New York City tax.

These are contributions that you make before any taxes are withheld from your paycheck. What taxes are taken out of your paycheck in Illinois. A 2020 or later W4 is required for all new employees.

1 day agoFederal tax rates are fixed and you can check your brackets here. Michigan tax year starts from October 01 the year before to September 30 the current year. This calculator is intended for use by US.

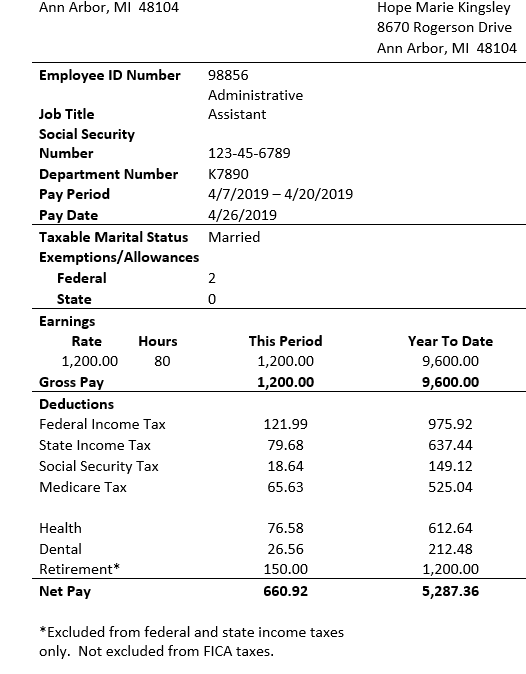

The tax rate for 2021 is 425. Mike and Meg may deduct up to 94618 from their adjusted gross income on their joint Michigan returns because Mike the older spouse was born before 1946. What is Michigans 2021 payroll withholding tax rate.

You can ask for an installment agreement and pay off your tax debt on balances of up to 50000 over 72 months according to Capelli. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator. The income tax is a flat rate of 425.

The personal exemption amount for 2021 is 4900. FICA taxes are commonly called the payroll tax. It is not a substitute for the advice of an accountant or other tax professional.

Amount taken out of an average biweekly paycheck. GOBankingRates found the total income taxes paid total tax burden and how much was taken out of a bi-weekly paycheck for each state. For a single filer the first 9875 you earn is taxed at 10.

Michigan Hourly Paycheck Calculator. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. What is Michigans 2021 personal exemption amount. How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

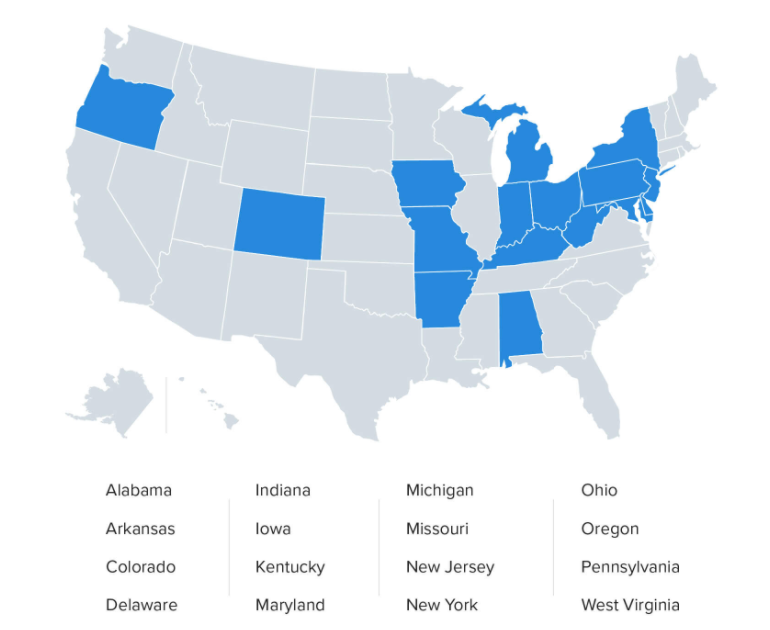

W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. Local income tax ranging from 1 to 24. So the tax year 2021 will start from October 01 2020 to September 30 2021.

What Taxes Are Withheld from an Illinois Employees Paycheck. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Michigan residents only. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

It can also be used to help fill steps 3 and 4 of a W-4 form. Only the very last 1475 you earned would be taxed at. All data was collected on and up to date as of Jan.

State Of Michigan Taxes H R Block

Understanding Your Pay Statement Office Of Human Resources

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Restaurant Server Salary In Detroit Mi Comparably

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Calculator Michigan Mi Hourly Salary

Michigan Income Tax Calculator Smartasset

For The Federal And State Taxes The Retirement Is Chegg Com

Paycheck Calculator Take Home Pay Calculator

Paycheck Protection Program A Look At Which Michigan Businesses Received Funds

Michigan Sales Tax Calculator Reverse Sales Dremployee

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Understanding Your Paycheck Human Resources University Of Michigan

Paycheck Taxes Federal State Local Withholding H R Block

Are You Withholding The Right Amount For Income Taxes Mi Money Health

Average Taxes Taken Out Of Paycheck In Michigan Tax Walls

Help Michigan W 4 Tax Information

Pay Stub Payroll And Disbursements Western Michigan University

This Is The Ideal Salary You Need To Take Home 100k In Your State