modified business tax return instructions

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU. SB 483 of the 2015 Legislative Session became effective July 1 2015 and.

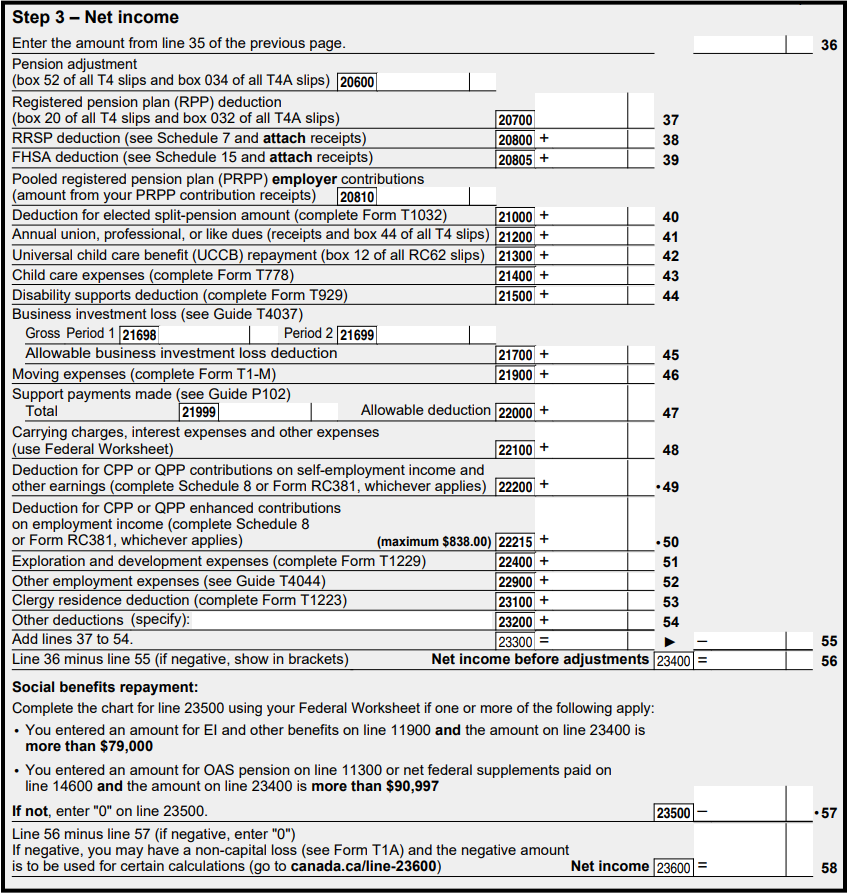

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

To amend a tax return for an S corporation create a copy of the original return on Form 1120-S and check Box H 4 Amended Return on the copy.

. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the. Then use the copy to make. Endobj 3 0 obj Type Page MediaBox 0 0 612 792 Parent 1 0 R Resources ProcSet PDF Text ColorSpace 6 0 R ExtGState 9 0 R Font 11 0 R Contents 33 0 R endobj 4 0 obj.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to. Instructions for Form 1040 Form W-9. File the 2021 return for calendar year 2021 and fiscal years that begin in 2021 and end in 2022.

How to get a copy of these instructions. POPULAR FORMS. Enter the smaller of line 1 or line 2 here.

Schedule G question 9b has been modified to clarify. Taxable wages x 2 02 the tax due. Total gross wages are the.

What is the Modified Business Tax. Individual Tax Return Form 1040 Instructions. File an amended return on Form 1120s by sending the return along with any schedules that changed to the address where the original S corporation tax return was filed.

For a fiscal or short tax year return fill in the tax year space at the top of the form. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. The maximum section 179 deduction limitation for 2021.

These instructions will help you complete the Company tax return 2022 NAT 0656 the tax return for all companies including head companies of consolidated and multiple entity. Enter the amount from line 3 here and on Form 4562 line 1. Download the Individual tax return instructions 2022 NAT 71050 PDF 165MB This link will download a file.

If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the PTC you must file Form 8962 and attach it to your tax return Form 1040 1040-SR or 1040. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU.

BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line. To get a copy of the instructions you can. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

Child tax cedit or the cr edit for other dependents such as the r foreign tax cedit education cr edits or general business cr editr Owe other taxes such as self-employment tax household. Select the document you want to sign and click Upload. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. BUSINESS TAX GENERAL BUSINESS.

Follow the step-by-step instructions below to design your modified business tax return nevada.

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Canadian Tax News And Covid 19 Updates Archive

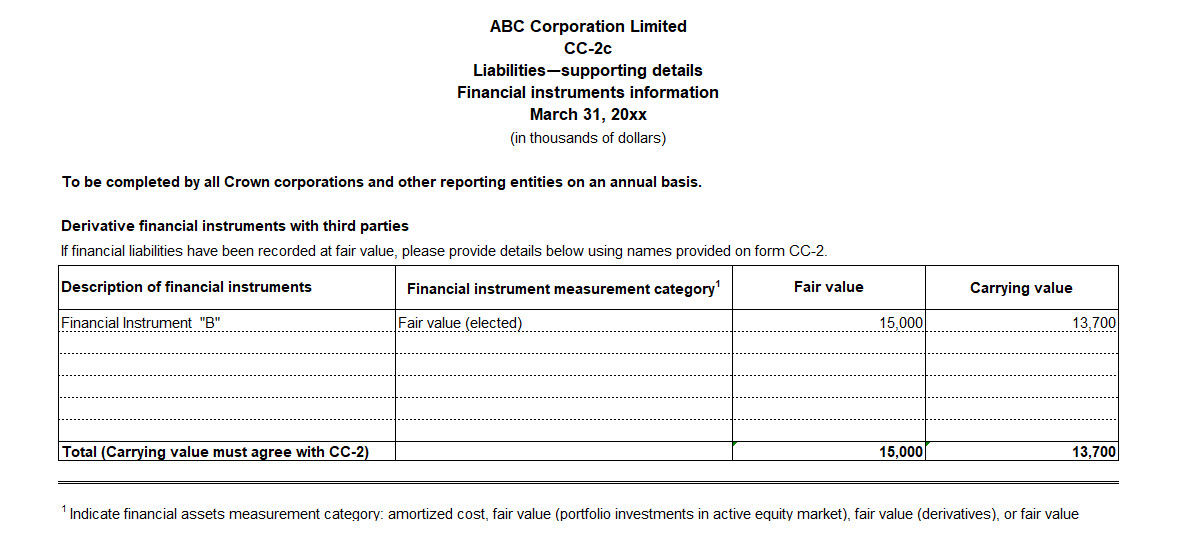

Reporting Instructions For Crown Corporations And Other Reporting Entities

Corporate Tax Report 2022 Spain

When To Consider A Protective 1120 F Filing Expat Tax Professionals

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Documents Store Payroll Template Printable Tags Template Money Template